kentucky transfer tax calculator

It is levied at six percent and shall be paid on every motor vehicle used in. The median property tax in Kentucky is 84300 per year for a home worth the median value of 11780000.

Nyc Nys Transfer Tax Hauseit Nyc Closing Costs Transfer

When ownership in Kentucky is transferred an excise.

. Motor Vehicle Usage Tax is a tax on the privilege of using a motor vehicle upon the public highways of the Kentucky and shall be separate and distinct from all other taxes imposed by. Kentucky Income Tax Calculator 2021. Overview of Kentucky Taxes.

Check this box if this is vacant land. The tax required to be levied. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. The tax rate is the same no matter what filing status you use. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

If you make 70000 a year living in the region of Kentucky USA you will be taxed 11753. Delaware DE Transfer Tax. You can use our Kentucky Sales Tax Calculator to look up sales tax rates in Kentucky by address zip code.

Kentucky imposes a flat income tax of 5. Transfer Tax Calculator 2022 For All 50 States. Property taxes in Kentucky follow a one-year cycle beginning on Jan.

Most counties also charge a county transfer tax rate of 150 for a combined transfer tax rate of 400. A deed cannot be recorded unless the real estate transfer tax has been collected. In fact the typical homeowner in Kentucky pays just 1257 each year in property taxes which is much less than the 2578 national median.

No Kentuckys tax rate applies to the full purchase price of the vehicle. Important note on the salary paycheck calculator. After a few seconds you will be provided with a full breakdown.

To use our Kentucky Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. The tax is computed at the rate of 50 for each 500 of value or fraction thereof. This calculator can only provide you with a rough estimate of your.

Iowa Real Estate Transfer Tax Calculator Enter the. For example if a car costs 20000 and the trade-in amount is 5000 you. 2 A tax upon the grantor named in the deed shall be imposed at the rate of fifty cents 050 for each 500 of value or fraction thereof which value is declared in the deed upon the privilege of.

Please note that this is an estimated amount. To use our Kentucky Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. 1 of each year.

For comparison the median home value in Mercer County is. The State of Delaware transfer tax rate is 250. Your average tax rate is 1198 and your marginal.

Assessment Value Homestead Tax Exemption. The states average effective. Your household income location filing status and number of personal.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. The calculator will show you the total sales tax amount as well as the county city. Aside from state and federal taxes many Kentucky.

For comparison the median home value in Kenton County is. Actual amounts are subject. Thats the assessment date for all property in the state so taxes are based.

Does a trade-in reduce sales tax in Kentucky. Kentucky Property Tax Rules.

Who Pays What In The Los Angeles County Transfer Tax

/Feature%20Sheet/9270%20Hwy%2025%20-%20Listing.jpg)

9270 Regional Rd 25 Milton Rural Halton Hills On Your Green Homes Real Estate

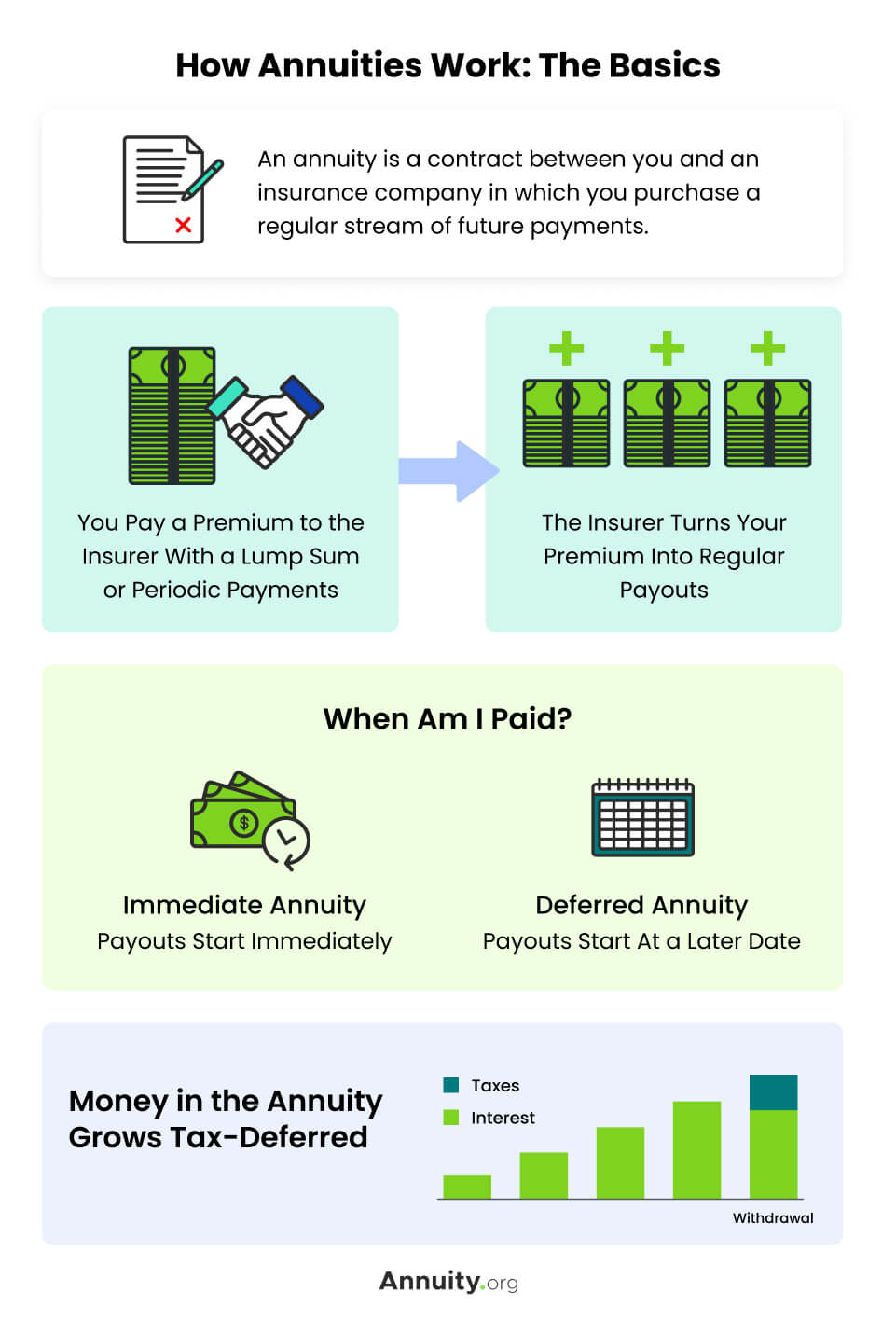

What Is An Annuity And How Does It Work Annuity Org

3 Ways To Make Sure Your Cash Gifting Is Legal Wikihow

Transfer Tax In Fresno County Who Pays What

Orange County Transfer Tax Quick Tip

Who Pays What In The Los Angeles County Transfer Tax

Credit Scores Explained Balance Transfer Credit Cards Paying Off Credit Cards Credit Card Payoff Plan

Property Tax How To Calculate Local Considerations

Clearview Home Search Rioux Baker Real Estate Team Collingwood Blue Mountains Real Estate

What S The Average Kentucky Real Estate Commission In 2022

What Are The Different Types Of Real Estate Property Taxes

Estimated Tax Penalties For Home Resales

Transfer Tax In Fresno County Who Pays What

How Much Does It Cost To Sell A House Zillow

Closing Costs Who Pays What When Buying Or Selling A Home Tilo Team Real Estate Closing Costs Selling House Home Repairs